Law Literacy- This article discusses a complete and up-to-date guide on filing for tax restitution for individual taxpayers at the Directorate General of Taxes (DGT). A detailed explanation of the procedures, requirements, and documents required for tax restitution are outlined, providing insight into the taxpayer's right to apply for a refund of tax overpayments. In addition, this article also explores the stages of the restitution process and the appeal mechanism in the event of a rejection of the restitution request. With actual data and credible references, this article is a valuable source of information for taxpayers who plan to apply for restitution or understand more about the latest tax policies.

Introduction

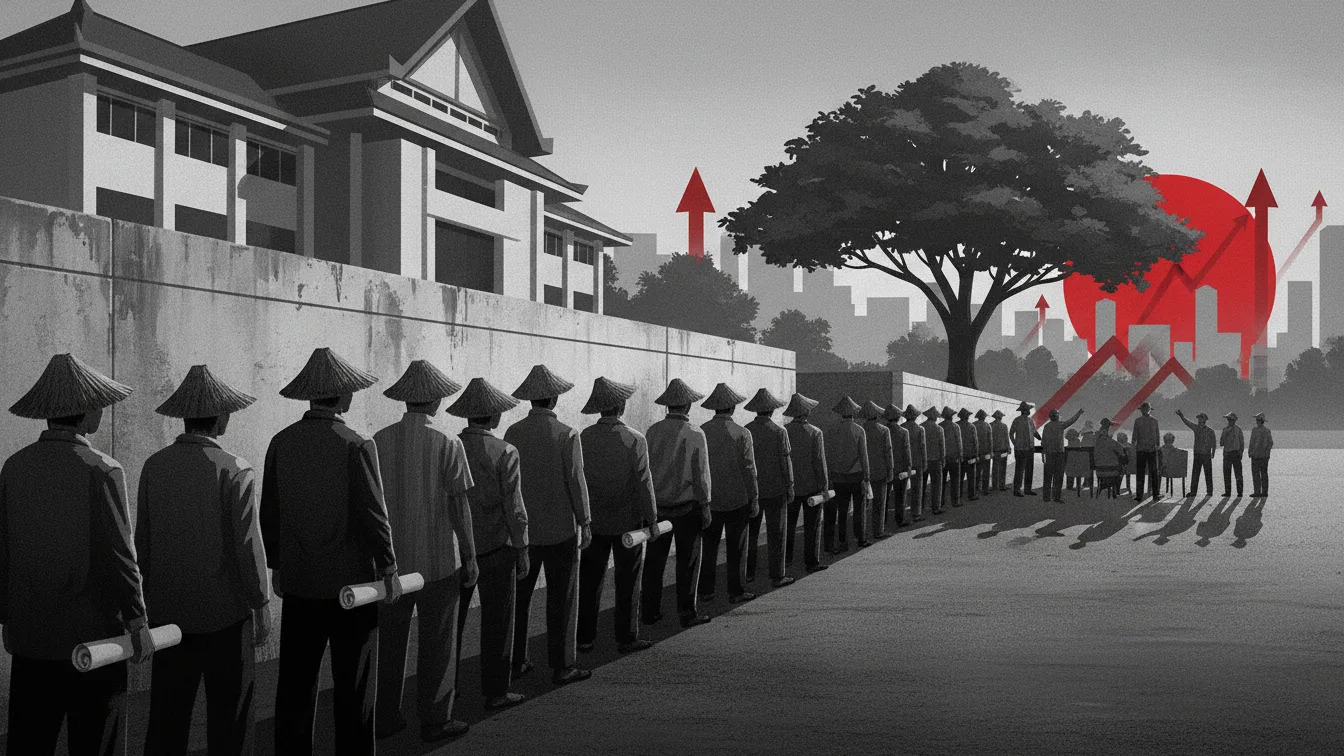

Legal provisions related to the submission of restitution by individual taxpayers at the Directorate General of Taxes aim to provide clear guidelines and procedures for submitting requests for restitution. Restitution is the return or reimbursement of tax payments that taxpayers have made in the event of overpayment or underpayment. This is important in maintaining tax fairness and justice for taxpayers. This provision is fully explained regarding the definition of restitution, the purpose of restitution, and the scope of restitution that applies in submissions by individual taxpayers at the Directorate General of Taxes.

In Article 17 of Law Number 6 of 1983 concerning General Provisions and Procedures for Taxation, as amended several times by Law Number 28 of 2007 (KUP Law), tax restitution is an application for the return of the amount of excess tax the taxpayer has paid to the state. This right arises if there is an overpayment of tax as stated in the Annual Tax Return (SPT) or if there is a recovery or deduction error that results in an overpayment of tax. This means that the DGT will return the tax paid by the taxpayer. For information, the realization of tax refunds throughout 2021 reached IDR 196.11 trillion.

Definition of Tax Restitution

Tax restitution is an application for a tax refund submitted by the taxpayer to the state. The term "tax refund" is regulated in the Law on General Regulations and Tax Procedures (UU KUP). Tax restitution occurs when a taxpayer pays more than the amount that should according to tax provisions. The state has the obligation to return the overpayment to the taxpayer after a series of audit processes by the Directorate General of Taxes (DGT). Tax restitution is the government's effort to create a healthy tax system and as a guarantee of trust given by the government to taxpayers. Tax restitution also aims to protect taxpayer rights.

Komentar (0)

Tulis komentar